Who We Are & What We Do

Your Community Foundation is a tax-exempt, 501(c)(3) nonprofit organization created by and for the people who live here. We connect people who care with causes that matter for here, for good, forever. We work with donors, nonprofits, and community leaders to improve the quality of life in the communities we serve. We accomplish this by building permanent charitable funds that benefit our communities today, tomorrow, and for years to come.

Whatever your charitable vision, we can help make it reality, whether that’s creating a named fund to build a legacy or giving in a way that secures your anonymity. By establishing a fund or giving to an existing one, you make a difference in your community.

We’re here to help, for good.

Planting Our Roots

On November 26, 1997, a small group of citizens with an abundance of enthusiasm embarked on a mission to secure the quality of life in our region now and forever. By yearend, they had a modest $1,050. Through commitment and vision, the Quincy Area Community Foundation expanded and grew to become the Community Foundation Serving West Central Illinois & Northeast Missouri.

Since planting those initial seeds, your Community Foundation has invested millions to help build and strengthen communities in West Central Illinois and Northeast Missouri. Assets from funds, mostly permanent endowments, continue to grow and grant to local arts and culture, community betterment, education, health, and human services organizations and programs. These grants affect individuals in each of the 12 counties we serve and beyond.

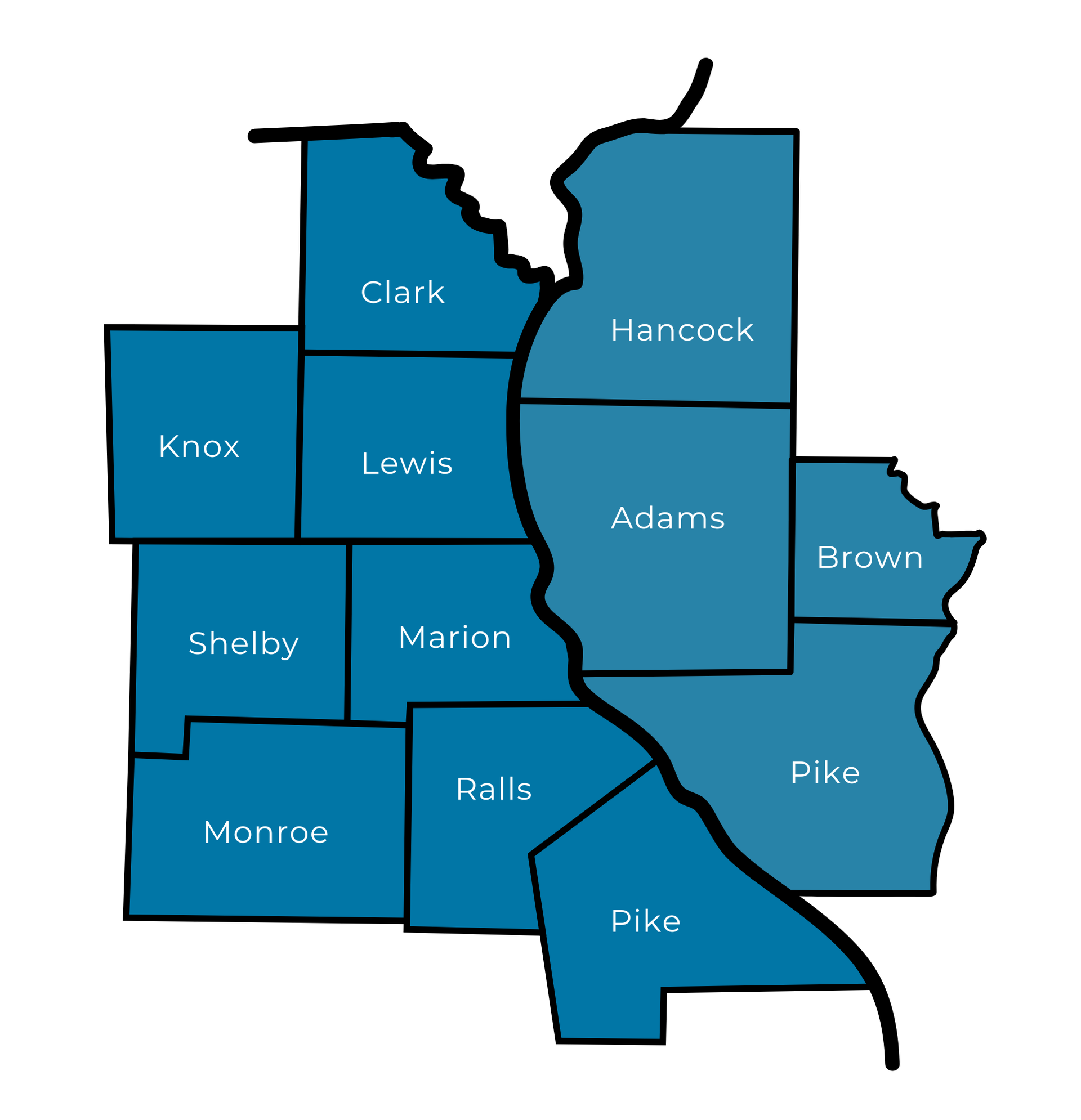

Serving 12 counties on both sides of the Mississippi River, we operate as a bridge between our donors’ charitable visions and the nonprofit organizations that bring those visions to life.

Gather

We work with individuals, families, businesses, and nonprofits to create tailor-made funds that help them make their charitable visions a reality. Donors can trust that the Community Foundation will act as a steward of those funds, ensuring funds are used according to their intent and vision.

Grow

Together with a team of trusted, local advisors, we invest funds to build endowments so they are available to support ever-changing needs and opportunities in the 12 counties we serve.

Grant

Based on our donors’ intentions and goals, we invest in our region to make our communities great places to live, work, and play.

Why Community Foundations

Every one of our donors has their own reason “why.” From honoring a loved one to securing a legacy, or simply “paying it forward” to the community that shaped their lives – there are countless reasons to give to your Community Foundation.

“When you donate, you donate one time. When you give to the Community Foundation you’re giving for life and you’re giving even after you’re gone.”

-Dennis Everly, H. Dennis Everly Fund & Herbert C. & Dorothy E. Everly Memorial Fund

Click here for Dennis Everly's story and partnership with the Community Foundation.

5 Reasons Why Giving

is Important

-

Impact

You care deeply about your community, whether you choose to define it by geography, ethnicity, age, interest, or any number of other factors, and want to continue supporting it beyond your lifetime. Giving can improve your community and in turn, boost the local economy.

-

Strengthens Personal Values

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links. -

Mood Booster

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links. -

Encourages Others

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links. -

Share Generosity

When your kids see you donating money, they’re much more likely to adopt a giving mindset as they grow up.

5 Reasons to Partner with the Community Foundation

-

Local

You care deeply about your community, whether you choose to define it by geography, ethnicity, age, interest, or any number of other factors, and want to continue supporting it beyond your lifetime. Giving can improve your community and in turn, boost the local economy.

-

Permanent

Endowments are at the heart of what we do. Permanent funds ensure there are resources providing support for good, forever, for our region. When you make a gift to or establish an endowed fund with the Community Foundation, the amount granted from the fund will eventually exceed the amount you gave.

-

Personalized

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links. -

Responsible

We carry the financial and legal responsibility. All of our funds sit under our Registered Charity Number, and we take care of all of the annual accounting, compliance reporting, and tax claims for the funds so you don’t have to.

-

Share Generosity

When your kids see you donating money, they’re much more likely to adopt a giving mindset as they grow up.

Stories of Impact

-

Black Hawk Elementary

For the majority of 2020 and 2021, parents and educators were worried whether or not schools would be able to reopen safely amid the COVID-19 pandemic. During the summer months of 2020, local schools took it upon themselves to plan and secure supplies to make classrooms as safe as possible. One of those schools taking a proactive approach was Black Hawk Elementary in Kahoka, Missouri.

Principal Betsy Parrish applied for a grant through the COVID-19 Nonprofit Response Fund at the Community Foundation in July and was awarded grant dollars to be used for student's health and safety.

"We were able to purchase chair back pockets for multiple classrooms, plastic pencil boxes to carry supplies, individual pencil sharpeners, individual dry erase markers and erasers, and a lot of hand sanitizer," said Parrish. "I also ordered 3M hooks so that teachers could hang student's backpacks and jackets from their desks so they wouldn't congregate at the coat hooks."

While returning to school during a pandemic may not feel normal, having safety supplies and resources on hand certainly helped ease the anxiety many families were facing.

For more on the Community Foundation's response to the COVID-19 pandemic, click here.

-

Birthday Blessings

We’ve all heard the saying, “It takes a village to raise a child.” This quote becomes even more pertinent when considering children and teens navigating the foster care system. In most cases, it takes a community to ensure these children grow up in a safe and healthy environment; that’s where Birthday Blessings comes in. The nonprofit, based out of West Plains, Missouri, provides hope and cheer to children not only on their birthday, but also on their first day of school, graduation day, during their transition to independent living, and more.

“Our mission is to meet needs and spread cheer in the Missouri foster community. Most of our kids come from a background of poverty,” says Birthday Blessings Executive Director Shannon VonAllmen. “They are victims of abuse and/or neglect. We want them to feel like someone recognizes their existence and values them.”

Currently, VonAllmen and her team of volunteers serve Ralls, Monroe, Marion, Shelby, Macon, Pike, and Lincoln Counties in Missouri. There’s currently a waiting list of circuits who wish to partner with Birthday Blessings; one of those is the 1st Circuit, which includes Clark County. Through a recent grant from the Community Foundation, VonAllmen says they will expand to Clark County and set up a better distribution location in the Hannibal area.

Even though Birthday Blessings is a small organization, they are having a big impact in the lives of vulnerable children in the Show-Me State and the Community Foundation is proud to partner with this agency to spread joy and meet childrens’ needs going forward.

-

Friends of the Log Cabins

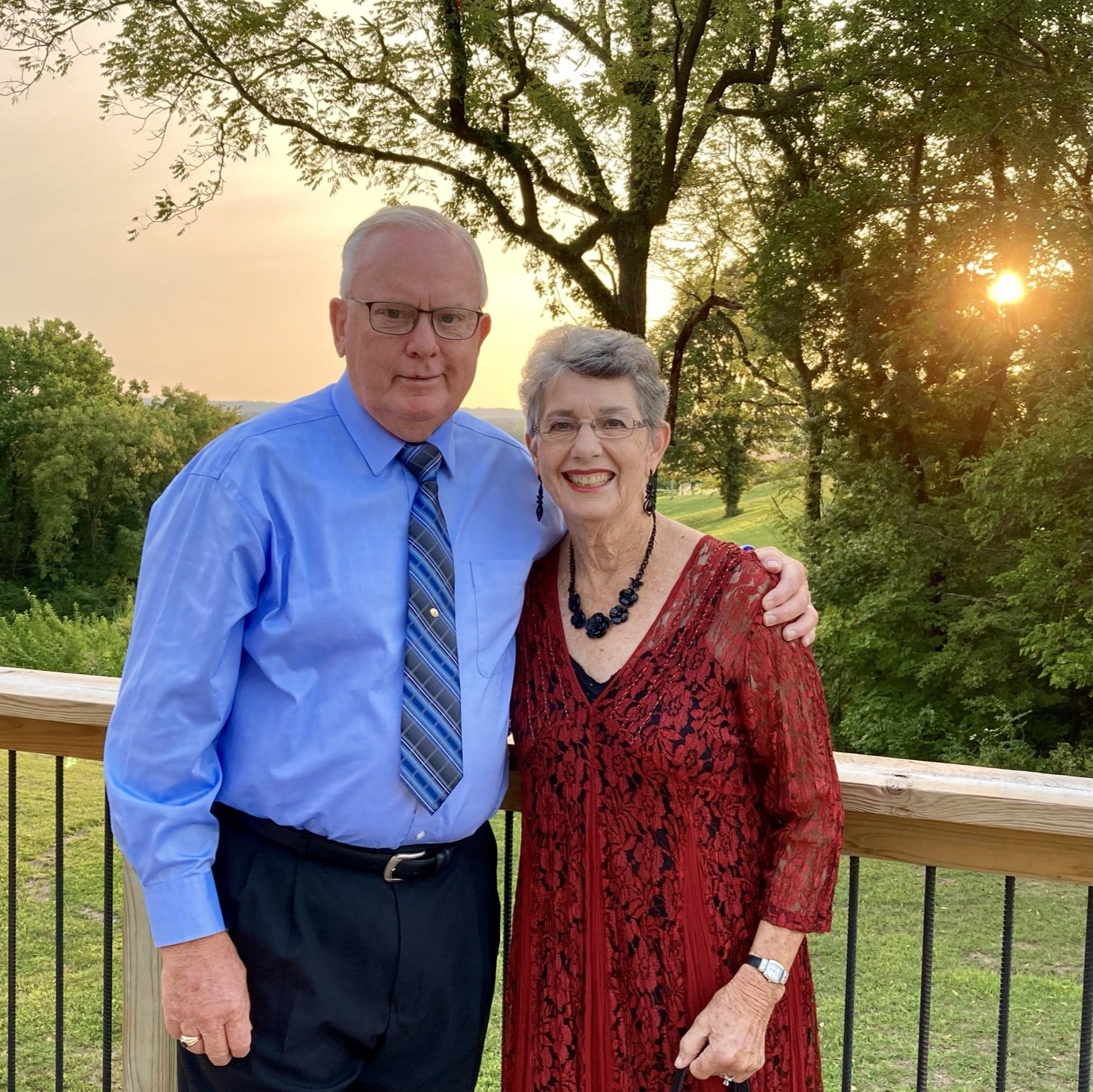

When you ask John and Betty Gebhardt what they’re passionate about, it’s almost an immediate response: the log cabins that sit on the Mississippi River’s Quinsippi Island Park.

The group of 1800s, Lincoln-era log structures include three cabins, a corn crib, a stone smokehouse and log church. A fourth cabin will be re-built later this year.

In 2007, a group of citizens noticed that the cabins were in need of attention and formed the Friends of the Log Cabins to “restore, preserve and utilize” these historic structures for current and future generations to enjoy. Ten years later, in 2017, the Gebhardts started the Friends of the Log Cabins Fund with the Community Foundation in order to secure a permanent source of income.

“We want to make sure it lasts forever and in order to do that we established an endowment fund which we hope people will contribute to,” said John. “It will eventually pay for someone to oversee this operation so there’s always someone responsible for it.”

Keeping the history alive on Quinsippi Island for generations to come is a goal for the Gebhardts and they encourage other organizations to plan for the future as well.

“Any organization that’s looking to last long term, needs to think about an endowment fund to cover the ongoing expenses, like staff, because that’s what it’s going to take to keep that operation going,” said John.

An endowment fund: inspiring and enabling local nonprofits to prepare for future success.

-

Legacy Theater

Although the line-up reads like that of a stage in Branson or Chicago, our region’s residents can take in the sights and sounds of The Bee Gees, Johnny Cash, and Willie Nelson in their own backyard.

The Legacy Theater in Carthage, IL hosts a variety of nationally performing tribute bands, musicians, magicians, ballet, and more. But, it’s not just providing big-city entertainment that makes The Legacy Theater a jewel in West Central Illinois. According to Joy Swearingen, Legacy Theater board member, it’s an economic and educational boom.

“Our Carthage restaurants show a noticeable increase in customers on show days. For the local folks, it is a great part of developing ‘quality of life’ for this rural area. Educationally, our schools, dance studios and music teachers have a wonderful place for their students to perform as well as become inspired by the arts through shows they see.”

The Legacy Theater received a 2019 Community Foundation competitive grant that will be leveraged through a matching campaign to raise money for professional-quality light and sound equipment. The theater was renting the equipment. By purchasing it, the theater will see a savings for each show and add to its continued improvement efforts.

-

Lincoln Colored School

The markers of the past can still be found in what used to be the Lincoln Colored School, which sits on the edge of Martin Park in Canton, Missouri. From the old school desks, to the students who etched their names on the wall, the restoration of the old school house ensures this piece of Canton’s past is preserved for future generation to learn from and allow its stories to continue being told.

“This school started back in 1881 and went until 1954 and educated African American kids,” said Phyllis Dean, project director at Lincoln Colored School. “Today, this school is still educating but we aren’t educating only African-Americans, we are opening it up to our community to learn from.”

Dean established the Lincoln Colored School Endowment at the Community Foundation to honor past students of the Lincoln Colored School while encouraging the success of current and future generations.

Beginning in 2023, the fund will help African-American students attending Canton R-V Schools reach their educational and extracurricular goals.

Frequently Asked Questions

-

What is the Community Foundation?

The Community Foundation Serving West Central Illinois & Northeast Missouri is a tax exempt, nonprofit, publicly supported philanthropic organization with IRS 501(c)(3) status that encourages philanthropy and creates opportunities to improve the quality of life for present and future generations.

-

When was the Community Foundation founded?

Your Community Foundation was founded on November 26, 1997.

-

What does the Community Foundation do?

Simply put, your Community Foundation gathers, grows, and grants charitable dollars.

It focuses on building permanent support—endowments—for needs and opportunities that matter to you: arts and culture, community betterment, education, health, human services, and more.

It holds those assets in separate funds established by donors: individuals, families, businesses, and charitable institutions. Each fund may have a special purpose, and the Community Foundation’s Board of Directors, representing the community, oversees them.

-

What “community” does the Community Foundation serve?

- It serves 12 counties in West Central Illinois and Northeast Missouri: Adams, Brown, Hancock and Pike in Illinois; and Clark, Knox, Lewis, Marion, Monroe, Pike, Ralls, and Shelby in Missouri.

- In addition to funding local nonprofit organizations, donors may also support regional, national, and international charities through the Community Foundation.

-

What is the total amount of grants distributed?

Since 1997, your Community Foundation has distributed more than $18 million in grants to nonprofits in our region and beyond.

-

What are the Community Foundation’s areas of interest?

Arts & culture, community betterment, education, health, and human services.

-

What is an endowment?

An endowment is set up to produce income for charitable purposes. A typical endowment fund will distribute only the income generated from investments. An endowment fund is likely (though not, of course, certain) to remain permanent as long as principal is not invaded and the distribution rate reflects the long-term growth patterns of investments.

Not all funds with the Community Foundation are endowments. Some donors prefer a greater distribution percentage of their gifts. Donors also use the Community Foundation for various other purposes, including short-term gifts, pass-through grants, and anonymous gifts.

-

What are the Community Foundation’s mission, values, and vision?

Our mission is “Connecting people who care with causes that matter.”

We value the highest ethical standards and stewardship principles, the power of philanthropy to change lives and communities, engaging others in improving the communities we serve, involving all segments of the communities we serve, and defining our goals and measuring the results.

Our vision is to be a leader in improving the quality of life throughout the communities we serve.

-

Why the Community Foundation?

For You: What matters most to you? Your Community Foundation works with you to meet your charitable goals and create a meaningful legacy.

For Your Community: Your gifts through your Community Foundation help support your favorite charity, cause, community, and more.

Forever: Because your Community Foundation focuses on endowment, your gift becomes a permanent asset to ensure funds will always be available to support your charitable interests.

-

Who receives Community Foundation grants?

Grants are made to nonprofit organizations with 501(c)(3) status and to government units for public, charitable purposes. We may also give grants to religious organizations, though the purpose may be restricted depending on the program from which the grant is made. Please see the Nonprofits section for more information on eligible organizations and grants.

-

Why not give directly to the charity I care about?

By all means. Support the charities you care about for their immediate needs and goals. And, when you give through the Community Foundation, you support the commitment to endowment (meaning your gift makes a permanent impact), ability to accept complex gifts, and professional expertise in managing and investing your gift. In some instances, a charity may be doing outstanding work in their mission area but does not have the financial expertise to manage and invest your gift for the best impact.

-

Why entrust my assets to the Community Foundation?

An endowment fund in your name, family name, or that of a loved one is a lasting way to support your favorite charitable organizations, causes, and communities throughout your life and leave a legacy long after you are gone. It is a powerful way to pass on the lessons of philanthropy to your children… and theirs.

The Community Foundation works hard to make giving easy and meaningful for donors and the causes they care about by:

- Accepting a wide variety of gift types that meet its Gift Acceptance Policy;

- Offering many fund types. You can name a fund, advise a fund, or designate an area of interest or specific charity to benefit;

- Handling fund administration. You get the joy of giving while the Community Foundation does the research, paperwork, grant follow-up, and reporting;

- Sharing community needs and opportunities expertise; and

- Endowing funds so that your charitable gift creates a permanent legacy.

-

What is the benefit of having a Community Foundation?

- It helps raise the level of local giving by keeping and building assets in its communities to serve its communities.

- It helps to ensure that charitable endowment gifts will remain effective and relevant now and for future generations. Even as local needs and opportunities vary, the Community Foundation can adapt charitable funds for relevance in a changing community.

-

What services do I receive as a donor?

The Community Foundation provides all IRS reporting, accounting and accountability for the funds (You are still responsible for your own personal tax reporting and should consult your tax advisor). The Community Foundation conducts due diligence to ensure that grant recipients meet the tests for tax-deductible status. When appropriate, the Community Foundation can help donors solicit proposals to fund certain categories of interest to the donor. Donor advisors are kept apprised of special community needs. We can also help donors publicize their funds or, conversely, act as the liaison to provide anonymity for donors.

-

What are the tax advantages of donating to the Community Foundation?

The Community Foundation offers one of the best tax advantages for charitable donations available under law. It is a publicly-supported nonprofit organization, qualified under section 501(c)(3) of the Internal Revenue Code. Since it is not classified as a private foundation, it is able to offer greater tax advantages. For example, there is a higher percentage of adjusted gross income threshold; donations of many types of assets to private foundations are generally limited to cost basis. Donors are encouraged to consult with their tax advisors.

-

What fees does the Community Foundation charge for services it provides?

Funds are charged an annual administrative fee, based on fund type. The fees supply resources necessary to operate efficiently and effectively, ensuring fiscal responsibility in carrying out those services associated with building charitable community assets, educating donors and communities, conducting grantmaking, research, collaboration, and other activities. Fund fees are generally 1-1.5% based on a fund’s type and whether it is endowed.

-

What and how do I give?

Individuals, families, businesses, and charitable institutions make gifts that meet their preferences and goals. The Community Foundation offers a variety of opportunities for giving at many levels.

- You can give any amount at any time to any fund at the Community Foundation. By combining your resources with those of others who share your interests, you can maximize the impact of modest contributions.

- The Community Foundation accepts gifts that meet its Gift Acceptance Policy: cash, securities, real estate, life insurance, retirement assets, commodities such as grain and livestock, and more.

- There are benefits to giving certain property, such as appreciated securities or real estate. Were you to sell the property, a substantial tax on appreciation could be due. When given to the Community Foundation, such gifts are not treated as sold by the donor, thereby avoiding capital gains tax that would otherwise be due if sold. In addition, the donor generally is entitled to a tax deduction equal to the fair market value of the donated asset.

- Giving grain to your Community Foundation lets you avoid including the sale of the grain in your farm income. Although a charitable income tax deduction is generally not available to you, the avoidance of declaring it as income can be a significant benefit.

- If you want to build your own fund, there are several options. For example, you can begin an Acorn Fund with as little as $1,000 and you have up to five years to build it to a named fund with permanent endowed status.

- You may also choose to give through your will or by using other planned giving vehicles.

- The Community Foundation also welcomes gifts specifically designated to support its work as a nonprofit organization.

-

What is the difference between the Community Foundation and private foundations?

The Community Foundation has tax advantages not enjoyed by private foundations. You do not have to form a Board of Directors, make investment decisions, or file an IRS 990 for a fund at the Community Foundation. The Community Foundation takes care of all fund administration, investment, grantmaking, and reporting for the fund. A broad and ever-widening group of unrelated individuals, families, corporations, and institutions contribute to the Community Foundation and its many funds. The one thing that connects donors is a desire to improve local communities.

By contrast, if you as an individual, family, or business form a private foundation, you must have a Board of Directors, establish bylaws, file an IRS PF-990, and more. If the principal endowment is not large, it rarely makes sense to establish a private foundation.

-

What is the difference between the Community Foundation and other nonprofits?

Most nonprofit organizations have a very specific mission. The Community Foundation’s mission is broad: connect people who care with causes that matter. This breadth reflects the ability to build a wide variety of charitable funds and make grants that benefit local communities.

Flexibility also allows the Community Foundation to serve a wider group of potential donors and a wider group of nonprofit organizations and communities.

Area nonprofits benefit because the Community Foundation helps money stay in the region. That means grants for local nonprofits. In addition, many nonprofits have established their own endowments with the Community Foundation.

As it has grown, your Community Foundation has become a center for charitable giving in and for this region. It serves as the bridge that helps make connections between the people who want to give and the charitable organizations, causes, and communities that matter to them.

-

How does the Community Foundation invest its funds?

Its Investment Committee provides direction and oversees multiple advisors and financial institutions who invest in a variety of instruments. They must adhere to the Community Foundation’s Investment Policy established and approved by the Board of Directors.

1. The primary focus is long-term with permanent endowments, which provide charitable grants now and into perpetuity.

2. The Community Foundation must comply with the Uniform Prudent Management of Institutional Funds Act (UPMIFA) summarized in the Component Fund Distribution & Fees Policy and the Investment Policy.

3. In determining grant distributions, the Community Foundation uses a 12-quarter 'look back' to even market volatility to meet the goal of providing a 'steady stream of support' from the charitable funds held here.

-

Can I get my attorney and financial expert involved? How?

Absolutely. The Community Foundation encourages you to work with your advisors—your attorney, accountant, banker, financial planner, or insurance representative. Professional advisors are vital in growing philanthropy in our communities. Please have them contact us to ensure we can meet your charitable goals.

-

What standards or credentials is the Community Foundation held to?

Your Community Foundation has earned the National Standards® seal from the Council on Foundations for attaining the highest standards of grant making integrity and standards.

The National Standards for U.S. Community Foundations® is an accreditation program created by community foundations for community foundations. They are peer-driven, voluntary, and self-regulatory.

Your Community Foundation is also a gold-level GuideStar participant, demonstrating its commitment to transparency.